In an era where technology is the cornerstone of the financial industry, safeguarding sensitive information and maintaining the integrity of data has become paramount. Financial institutions are constantly faced with the challenge of ensuring the security of their systems, especially when it comes to Application Programming Interfaces (APIs) and API security. The Federal Financial Institutions Examination Council (FFIEC) has established security guidelines and addressed API security specifically in its most recent Authentication and Access guidance.

Understanding API Security

Before we dive into the specifics of FFIEC’s requirements, let’s grasp the concept of API security. APIs act as bridges between different software systems, enabling them to communicate and exchange data seamlessly. They play a pivotal role in enabling financial institutions to offer innovative services to customers, but they also introduce potential security vulnerabilities. Hackers are continually looking for weak points in APIs to gain unauthorized access, steal sensitive data, or disrupt services.

Cequence Security provides an industry leading Unified API Protection platform that can be the foundation of any financial services API security strategy that provides full API lifecycle protection. Finance organizations have invested in Cequence Security for API inventory, compliance, testing, mitigation, and fraud. Cequence currently secures billions of API calls per day user accounts across its customer base.

The FFIEC API Security Framework

The FFIEC, a consortium of regulatory bodies overseeing financial institutions in the United States, recognized the need to set standards for security to ensure the safety of financial transactions and customer data. Their security framework serves as a blueprint to help financial institutions identify and mitigate risks associated with API usage, among other things. Based on the categories below we have outlined where Cequence can provide immediate protection and assessment for your API protection strategy.

1. Authentication and Access Control

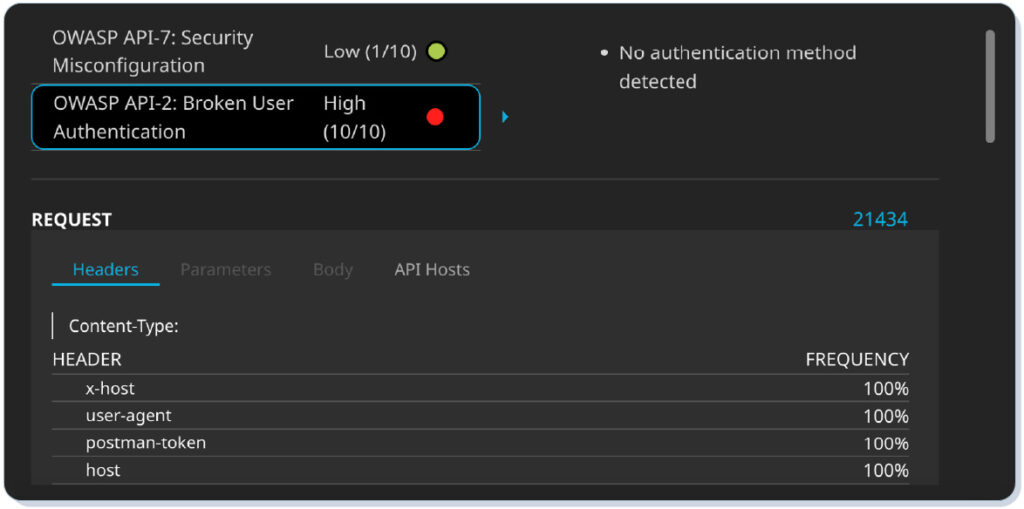

The first pillar of the FFIEC framework focuses on ensuring proper authentication and access control mechanisms. Institutions are required to implement strong authentication methods, such as multifactor authentication (MFA), to verify the identity of API users. Additionally, access control mechanisms must be in place to restrict API access to authorized individuals or systems.

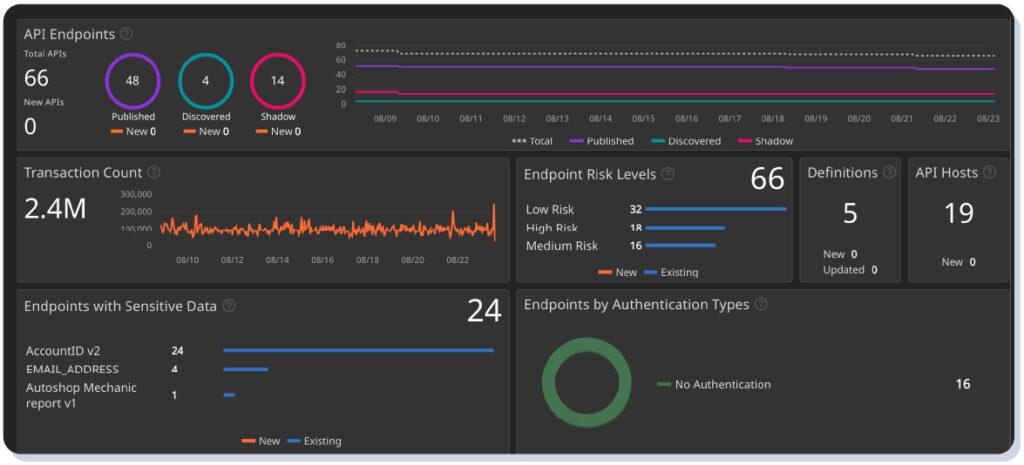

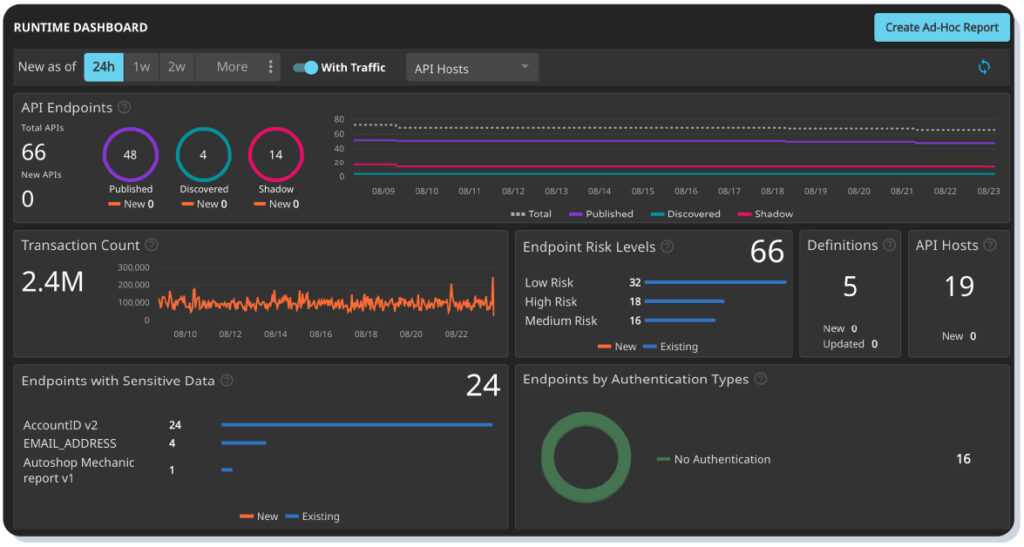

Cequence offers agentless discovery with no software or traffic redirects, providing a complete view of your external and internal APIs in a matter of minutes.

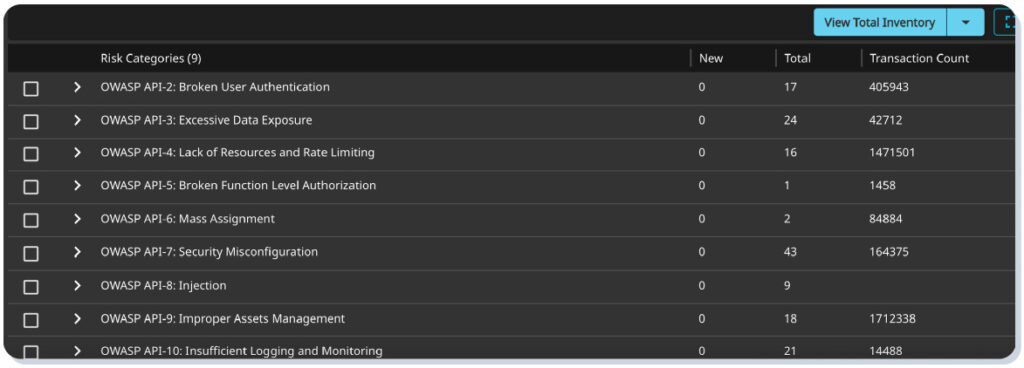

Cequence can also provide an analysis of runtime traffic for OWASP Top 10 identity authentication weaknesses that may exist in your API landscape.

2. Encryption and Data Protection

Encrypting data is a fundamental aspect of securing APIs. The FFIEC mandates the use of encryption for data both at rest and in transit. This ensures that sensitive information remains unreadable even if intercepted by malicious actors.

3. Audit and Monitoring

Proactive monitoring is crucial for identifying and responding to potential security breaches swiftly. Financial institutions must implement audit logs that track API usage and any unusual activities. These logs aid in detecting and investigating security incidents.

Cequence Security unifies API discovery, inventory, compliance, dynamic testing with real-time detection and native detection to defend against fraud, business logic attacks, and data leakage.

4. Secure Development and Testing

Developing and testing APIs securely is a cornerstone of the FFIEC framework. Institutions are encouraged to follow best practices during the development lifecycle, conduct thorough security testing, and promptly address vulnerabilities.

Cequence uses Generative AI to automatically generate security test cases customized to your unique APIs, business, or vertical. Comprehensive API testing of your application in the CI/CD pipeline ensures critical vulnerabilities are remediated before production.

5. Incident Response and Recovery

Even with robust security measures, incidents can occur. The FFIEC requires financial institutions to have well-defined incident response and recovery plans in place. These plans should outline steps to mitigate the impact of breaches and ensure the continuity of services.

6. Third-Party Risk Management

Many financial institutions rely on third-party APIs to enhance their offerings. However, these third-party integrations can introduce risks. The FFIEC stresses the importance of assessing and managing third-party risks through due diligence, contract negotiations, and ongoing monitoring.

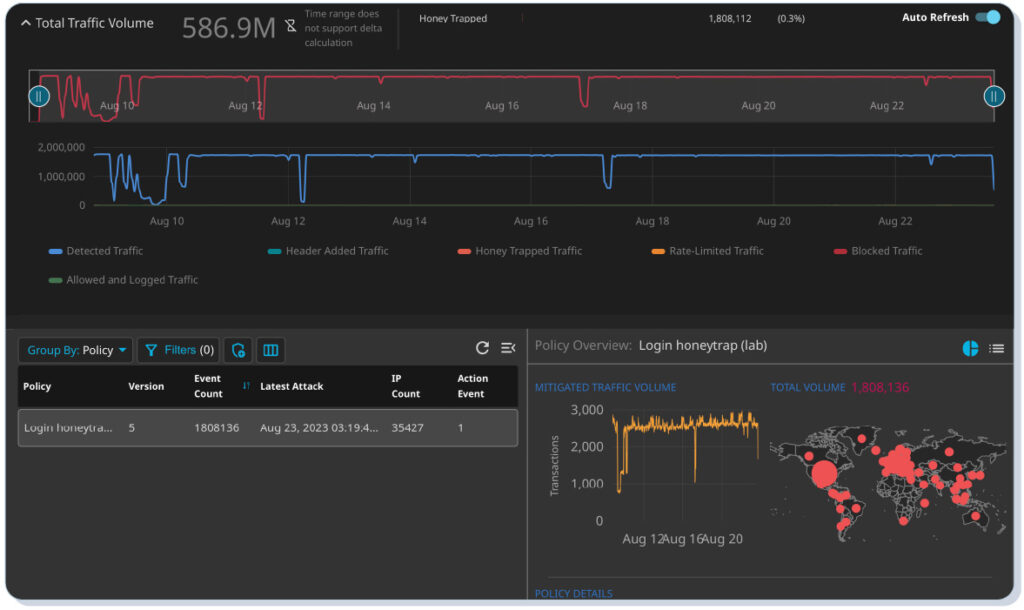

This is another strength of Cequence Unified API Platform protection. Cequence enables organizations to assess APIs and runtime traffic and what is coming in, where it is coming from, and when to mitigate.

Embracing the Future of API Security

As technology continues to evolve, so do the tactics of cybercriminals. The FFIEC API security requirements provide a foundational framework to help financial institutions navigate the complex world of API security. However, it’s important to note that these requirements are just a foundation; they should be seen as a starting point for building a strong security posture.

Financial institutions should continuously educate their teams about emerging threats and best practices, conduct regular security assessments, and adapt their security strategies accordingly. Collaborating with cybersecurity experts and staying updated on industry trends is essential to stay ahead of potential risks.

Cequence Security can play a crucial role for financial services organizations in complying with FFIEC API security guidance and securing their financial systems. By adhering to these guidelines, financial institutions can contribute to the creation of a secure and resilient financial landscape, where customers can trust that their sensitive information remains protected, and transactions occur without a hitch.

See also: check out our blog and view our webinar about the new CFPB open banking rule with new guidance around API security and compliance.